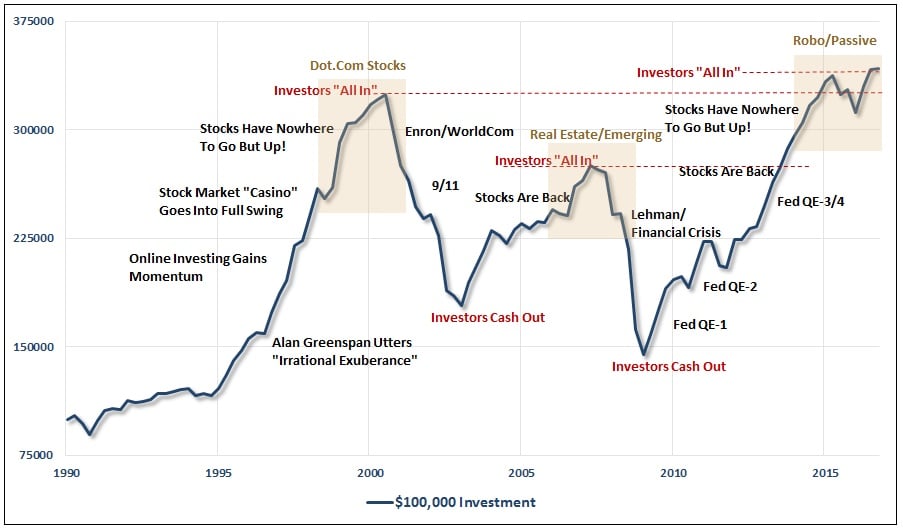

Investors do not need reminding of how each of those periods ended in 1974, 1987, 2000, and 2007. However, after each crash, we always heard investors say; "this time will be different".

Passive investing has seen a record increase in the past decade, growing to nearly 6,000 indexes today, up from fewer than 1,000 a decade ago, and have been fashioned as a low-risk, low-cost and non-opinionated way to participate in the investment market. Exchange Traded Funds (EFT) have been boasted as being able to rid investors of their worries and bring the market back to full health. Sounds confident enough, at first. However, when diving further into the subject of passive investing, we see that it is not the final solution some have been leaning to believe it is, and we find its value is most potent when used properly and in moderation.

““By definition, index funds also guarantee that you will suffer 100% of the next year market’s decline.””

– James Stack, InvesTech Research

The passive myth

Let us start off by saying that passive methods are not all bad; they work great in Bull Markets. Simply put, a passive investment strategy follows an index, and in a Bull Market when this index rollercoaster is going up, it's great. Nevertheless, as the old saying goes "what goes up, must come down" - or better yet, we can reference one of Wall Street Veteran Bob Farrell's trading rules; Excesses in one direction will lead to an opposite excess in the other direction. Not exactly reassuring news when riding the proverbial index rollercoaster on the way down.

Markets that overshoot on the upside will also overshoot on the downside, much like a pendulum. The further it swings to one side, the further it rebounds to the other side. As an example, the chart below shows the NASDAQ bubble in 1999 and the Percent Price Oscillator (PPO) moving about 40% - this means the NASDAQ was 40% above its 52-week moving average and way overextended. Then, only a couple years later in 2000-2001, the PPO moved below -40%.

Still want a ticket on the index rollercoaster?

Stockcharts

Following an index can be turned into an advantage; experienced active managers can benefit from following passive methods up along an index - selling or moving funds when necessary to avoid the losses when the familiar pendulum inevitability swings downward. After all, this is what active money managers research and look at all day long.

““Embracing passive investing is exactly this sort of ‘cover your eyes and buy’ sort of attitude. Would you embrace the very same price-insensitive approach in buying a car? A house? Your groceries? Your clothes? Of course not.””

- Lance Roberts, Real Investment Advice

Without active money managers at the helm of your investment strategy, many passive investors tend to become an "active panic seller." It is only near peaks in extended Bull Markets that logic is dismissed for the seemingly easiest trend to make money. Another way of looking at this would be "emotional investing".

Real Investment Advice

The chart above displays a trend of active panic selling, or emotional investing. So, just remember; everyone is passive until the selling beings. In fact, we can reference two of Bob Farrell's investment rules here; The public buys the most at the top, and the least at the bottom - also; Fear and greed are stronger than long-term resolve. Both rules refer to human behaviour and emotion in stock trading.

While on the topic of emotion - today, Millennials who watched their parents get decimated twice by the financial markets have unwittingly been lured back in the investment casino through the one thing Millennials love most; Apps. There are Robo-advisor apps and entire platforms that promote long-term success through passive approaches to investing. Again, the markets simply do not function that way.

Repetitiveness and concentration in passive strategies

People are not bullish on stocks - they are bullish on the stock market. Most of these people are not thinking about the S&P 500 stocks as 500 stocks, they are thinking about it as an asset unto itself. So, when people talk about an index, they are not talking about the benefits of diversification anymore. One reference to this would be ETF's, buying the S&P 500 and following the index is an example of a passive investment strategy.

One of the most significant issues with ETF's would be that people often do not know what is in them, they see an ETF as a single stock and not a collection of stocks, as mentioned above. There are a few problems with this, most commonly it is the repetitive stocks across all their ‘diversified' ETF holdings. Holding multiple ETF's carrying the same stocks has the potential to sink your entire portfolio in the event of a market downturn. The rising stock market and the fact that index funds have performed better than some financial forecasters had predicted over the past years could be blinding investors to the increasing damage that indexing is already doing, and could still do, to the market and the economy.

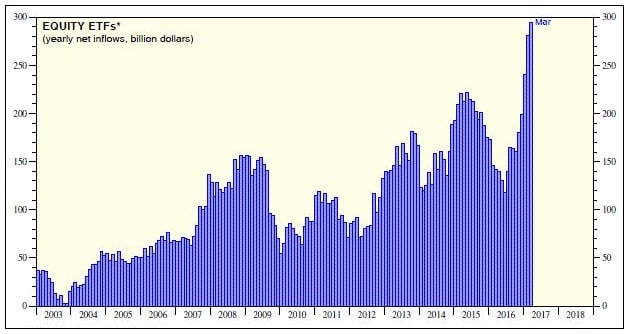

Below we see how the rising trend is developing.

Investment Company Institute

In the chart above, the money keeps pouring into equity ETF's. The latest data from The Investment Institute shows that they attracted $38.1 billion during March, $98.6 billion during Q1, and $198.7 billion since November when Donald Trump was elected president. Over the past 12 months through March, equity ETF's attracted a record $295 billion.

No wonder the S&P 500 is up 7.1% YTD and up 12% since Election Day. (Percentage and Currency values in USD - Stats as of October 2017)

Concentration in the passive fund market has already been established by an oligopoly known as The Big Three; Vanguard, BlackRock, and State Street. Media outlet; The Conversation, went as far to say, "these three firms own corporate America". Together, The Big Three are the single largest shareholders of close to 90% of S&P 500 firms.

Overall, between the three, they own almost three-quarters of all passive-management investment stocks.

More on The Big Three and ETF concentration: The EFT Downside

An extreme such as this allows these investment dynamos to accumulate assets by slashing costs. The more assets they gather, the more they can reduce fees and continue their expansion. In contrast, active managers room for tactic is inhibited by liquidity and size.

There are significant implications here. As ETF and index product demand grows, a substantial portion of the world's listed companies will come under the control of the three largest investment management companies; when these three firms already own close to 20% of US large-cap companies.

So, what happens when a small group of three passive shareholders control most or all the companies in a given industry? Two changes are likely to occur; the first is a fading of corporate governance standards and the second is an erosion of competition.

Both changes equal to an unwarranted and enormous concentration of power.

Furthermore, this type of concentration in ETF's creates an environment in which poorly managed companies can see their stock prices rise along with those of well-managed companies. If they share an ETF, the boat rises with all stocks inside.

““Passive investment strategies have grown in popularity among investors, but they present a ‘frightening’ risk to the markets””

– Strategist, Morgan Stanley

Bottom Line

We do not deny the utility of passive investment - however, addressing the myth that passive investing is a fail-safe investment method without danger is essential. Although, index products can have their benefits to investors when managed correctly.

The problem is many embrace passive investing without looking past the title. Diversification within a portfolio is key to protecting yourself, and one of the tried-and-true ways of achieving a well managed diversified portfolio is an experienced active manager, or better yet, a team of experienced active managers and researchers.

We are looking outside the box by exercising caution when considering the heavy weight of ETF holdings.