ETF's are commonly used as a passive management strategy, meaning their purpose is to match index performance not outperform it. Essentially, they are built like a mutual fund but offer lower fees, higher liquidity and trade like a common stock on an exchange.

Many ETF's are market-cap weighted, meaning that the individual components of the fund are weighted according to the total market value of their respectable shares. The problem with this is that as a company's stock price increases so does its market cap, resulting in an increased weighting within the fund which, in turn, further increases the stock's price - ultimately, valuations fall by the wayside. Ironically, market-cap-weighted ETF's will always have their largest positions in stocks at their peaks - somewhat contradictory to the adage of buying low and selling high.

““The boom of passive investing in stock market indexes via EFT’s is collective lunacy – investors are buying regardless of valuations.” ”

– Christopher Wood, CLSA

As we continue to progress through this bull market, one cannot help but notice increasing complacency and lack of volatility in the overall markets. We are nine years removed from the great 2008 market crash, and we are running at all-time highs and record valuations - has history not taught us anything? Some argue that passive investing is partially to blame, and there is some compelling evidence to suggest they may be onto something. With the meteoric rise of ETFs, a company's fundamental business prospects are a thing of the past, surrendering to merely being present in popular indexes. Poorly managed companies enjoy rising stock prices, reaping the benefits of being pooled together with well-managed companies - herein lies the ETF dilemma or Diworsification.

Diworsification: a play on the word diversification. The Diworsification is the process of adding investments to one's portfolio in such a way that the risk/return trade-off is worsened. Diworsification is investing in too many assets with similar correlations that will result in an averaging effect.

More on Diworsification: Passive VS Active Investing

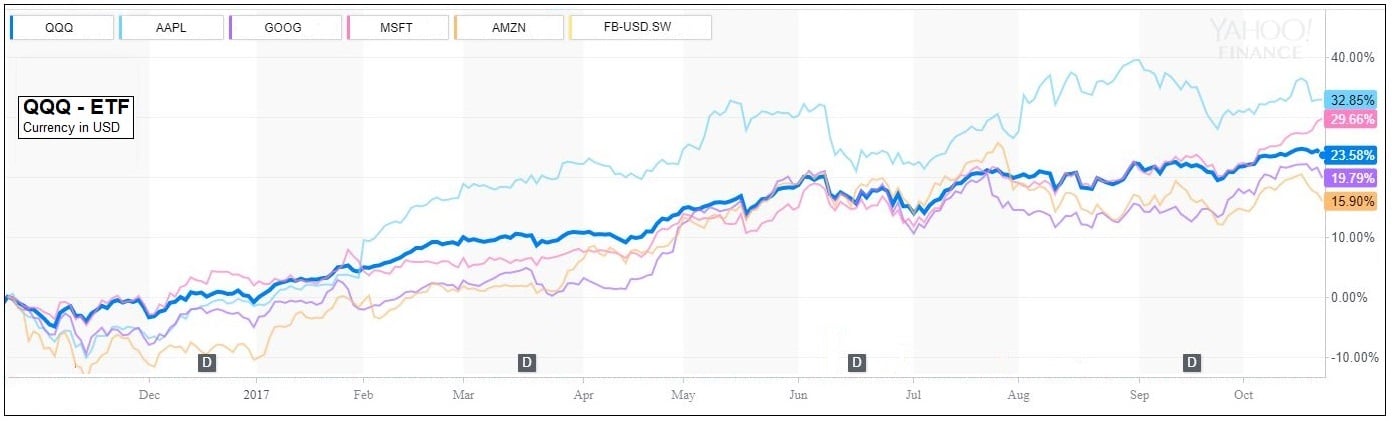

To quote John Mauldin, as we did at the beginning of this article, the world-renowned financial expert says; "people aren't bullish on stocks, they are bullish on the stock market. And philosophically, nobody is really thinking about the S&P 500 stocks as 500 stocks. They are thinking about it as an asset unto itself. It has a price. And, when people talk about indices, they don't talk about the benefits of diversification anymore." With this in mind, let's use QQQ, the ETF which tracks the NASDAQ-100 Index - the 100 largest non-financial securities listed on the NASDAQ exchange - as an example. Only five companies, Apple, Alphabet, Microsoft, Amazon, and Facebook, make up 42% of the entire QQQ ETF. This means that 42% of the funds you have just invested in QQQ goes to only five stocks, leaving the leftover 58% for the remaining 95 stocks - so much for diversified index coverage. In the chart below, we can see how much these five stocks influence the QQQ YTD.

Yahoo Finance

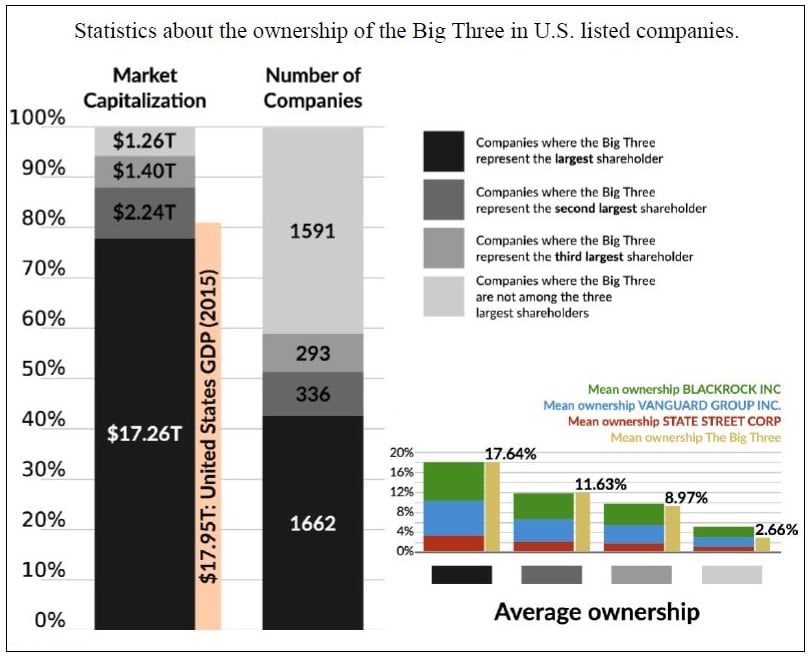

Although we currently hold a few ETFs, we believe it is necessary to be cautious of the impact fund companies have on the markets. Our ETF selection is specific, and selected to fit our explicit global themes, without any correlation to other assets we hold - making our portfolio entirely diverse. Most alarming are the rapidly evolving index funds oligarchy being created by BlackRock, Vanguard and State Street. Together, "The Big Three" have over ~$11 trillion in assets under management and hold the largest shareholder position in ~40% of all US publicly listed companies and ~90% of all S&P 500 companies. Combining all factors, from the substantial control of ETF providers to the very few companies driving all market performance, a true correction has the potential to cause a selloff that will, unfortunately, catch many off-guard. Stats from Corpnet, University of Amsterdam.

So, concentration in the passive fund market has already been established by the oligopoly previously mentioned as The Big Three; Vanguard, BlackRock, and State Street. Media outlet; The Conversation, went as far to say, "these three firms own corporate America". Together, The Big Three are the single largest shareholders of close to 90% of S&P 500 firms, including Apple, Microsoft, ExxonMobil, General Electric, and Coca-Cola. Overall, between the three, they own almost three-quarters of all passively-management investment stocks.

Now, you might be asking yourself; "Is this legal?" BlackRock recently argued that legally it was not the "owner" of the shares they hold, but rather a "custodian" for other investors - a solid shield. This shield allows these three to have concentrated the passive fund market and control it.

An extreme such as this allows these investment mavericks to accumulate assets by slashing costs. The more assets they gather, the more they can reduce fees and continue their expansion. In contrast, the liquidity and size inhibit an active managers strategy.

There are significant implications here. As ETF and index product demand grows, a substantial portion of the world's listed companies will come under the control of the three largest investment management companies; when these three firms already own close to 20% of US large-cap companies.

Orbis

This collection of passive funds is not happening under the radar, CEO's are aware The Big Three are their firm's dominant shareholder and take this into account when making decisions. - See the problem developing here?

As a speculative example: airlines have less incentive to lower prices because doing so would reduce overall returns for The Big Three, their familiar owner.

So, what happens when a small group of three passive shareholders control most or all the companies in a given industry? Two troubling changes are likely to occur.

The first is a fading of corporate governance standards, a dangerous development. Corporate governance standards are a set system of rules used to guide practices and processes by which a company is directed and controlled. When an outside shareholder owns the company's majority shares, their influence is so powerful they can overlook the governance standards as they do not necessarily pertain to them. One of these governance practices would be fair treatment of shareholders; this is where the favouring of certain majority investors could see the scales tipped toward them.

The second is an erosion of competition, by which the massive holdings of passive shareholders create the conditions for oligopolistic corporate practices, such as price or product control. In relation to our speculative example earlier; the US airline sector, in which the most prominent firms are owned by the same large, predominantly passive institutional money managers, competition among carriers has dwindled, causing a spike in passenger airfares.

Passive supremacy does not happen rapidly. However, when left unregulated, the growth of index-trackers has the potential to erode the market-based economy, one industry at a time.

““If indexing continues the way it has, we are likely to see a much different financial landscape then we do now, and fast.” ”

– Stephen Gandel, Bloomberg News

There is also a geopolitical blockquote here. If the passive giants end up owning large amounts of the capital market, they will have a significant say on the composition of stock and bond indexes. Granting them the ability to determine which country or company should be included or excluded from those benchmarks, they would wield enormous influence over international capital flows.

An unwarranted and enormous concentration of power? We would like to think it is quite evident.