Timing is everything, and when it comes to withdrawing your Canadian Pension Plan (CPP) and Old Age Security (OAS) payments, making an informed decision becomes crucial for maximizing your retirement income and ensuring financial stability in your golden years.

Your CPP amount is influenced by several factors, including the age at which you decide to start your pension, the duration and extent of your contributions to the CPP, as well as the average earnings accumulated throughout your entire working career. To get an estimate of your monthly CPP and OAS retirement pension payments, you can sign in to your My Service Canada Account.

CPP

The CPP is a monthly taxable benefit designed to replace a portion of your income upon retirement. To qualify, you must be at least 60 years old and have made at least one valid contribution to the CPP, which can come from work in Canada or through credits from a former spouse or common-law partner at the end of the relationship.

-

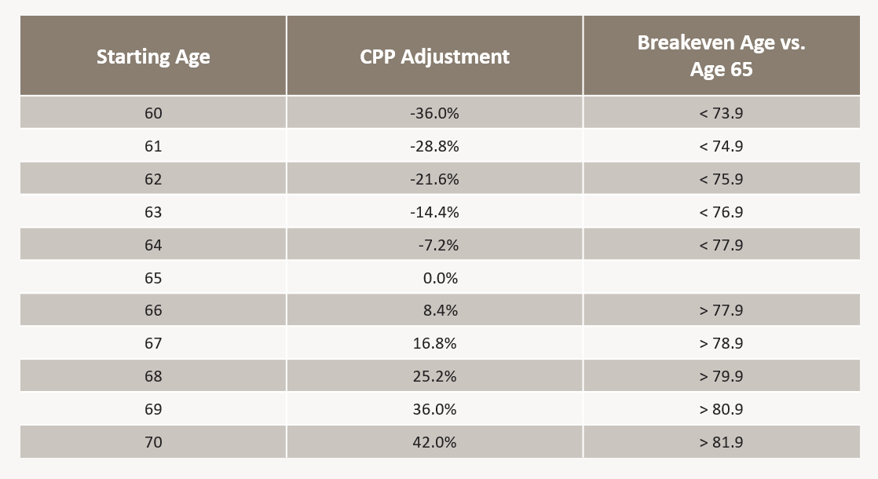

For every month before age 65 that you start collecting CPP, the benefit amount is reduced by 0.6%. That amounts to a reduction of 7.2% per year. If you start at the earliest possible age of 60, your monthly benefit will be 36% lower than if you had waited until 65 to collect.

-

For every month after age 65 that you delay collecting CPP, the benefit amount is increased by 0.7% (or 8.4% per year). The latest you can delay receipt of CPP is 70, at which point you will get 42% more per month than if you had started at 65.

EXAMPLE

If you qualify for a $1,000 monthly payment at age 65, choosing to start collecting at age 60 would result in a lifetime monthly payment of $640 (or a 36% reduction), adjusted annually for inflation. Alternatively, if you delay until age 70, your monthly payment would be $1,420 (or a 42% increase), a substantial difference from the $1,000 at age 65.

OAS PAYMENTS

Likewise, you can receive an additional 0.6% in OAS pension payments for each month (equivalent to 7.2% annually) you postpone past the age of 65 to a maximum increase of 36% at age 70.

THE BREAK-EVEN CALCULATION

The “break-even” age refers to the point beyond which you would have been better off delaying CPP. Opting for CPP at age 60 results in a reduced monthly cheque, but it also grants an initial head-start advantage over those who wait for a bigger monthly sum. Over time, the larger cheques for patient individuals who delay will enable them to catch up. The break-even calculation estimates the ages at which that happens. The chart below depicts these ages along with their corresponding CPP adjustments.

A general guideline is that if you don't anticipate living beyond 74, starting CPP at 60 may be prudent, while if you expect to live beyond 82, it's usually in your best interest to delay until age 70, resulting in a 42% increase in all CPP payments. Keep in mind that individual situations may differ with respect to factors like other income sources, taxes, and OAS clawbacks.

THINGS TO CONSIDER

1. Think About Life Expectancy

Obviously, none of us know exactly how long we’ll be around. If you’re healthy and expect to live past 80, waiting until you’re 70 to collect both CPP and OAS will maximize the benefit payments you can receive throughout your lifetime.

2. Consider Your Total Income

It’s crucial to assess all your sources of income (pension income, registered account withdrawals, non-registered investments, wages, etc.) before making a decision.

a. Although there are no clawbacks for CPP, the payments are taxable.

b. For OAS, the clawback threshold starts at an income level of $90,997 in 2024. Every dollar earned above this level at a rate of 15% will affect your OAS payments.

3. Look at Your Lifestyle

Even if delaying CPP and OAS benefits could potentially be financially advantageous, you may opt to start collecting early to have additional funds sooner for travel, supporting loved ones, or simply to enhance your sense of security with a surplus income cushion.

BOTTOM LINE

Whatever you decide, be sure to run the numbers. If you don’t require funds for immediate expenses, delaying can be appealing. Alternatively, you can take the money and invest it. To be better off, you would have to earn a higher rate of return than the increases in benefits would provide. The best age to start collecting your retirement pension depends on your circumstances: your health, financial situation, and retirement plans.