“In theory there is no difference between theory and practice. In practice there is.”

Yogi Berra

Many, prefer to invest exclusively in the passive world. Whether you are investing in a broad Exchange Traded Fund (ETF) (say the SPY) or a handful of ETFs (via your robo-advisor's algorithm) neither offer you the much-needed diversification and liquidity when you need it most. Unfortunately, during market corrections and increased volatility, most ETFs move in unison and you can throw the benefits of diversification out the window.

Don't get us wrong, there is a time and place to invest in thematic ETF's - think e-commerce (EMQQ) or dim sum bonds (DSUM) vs. an over-diversified index ETF (SPY).

In today's world, everyone is trying to gain an edge.

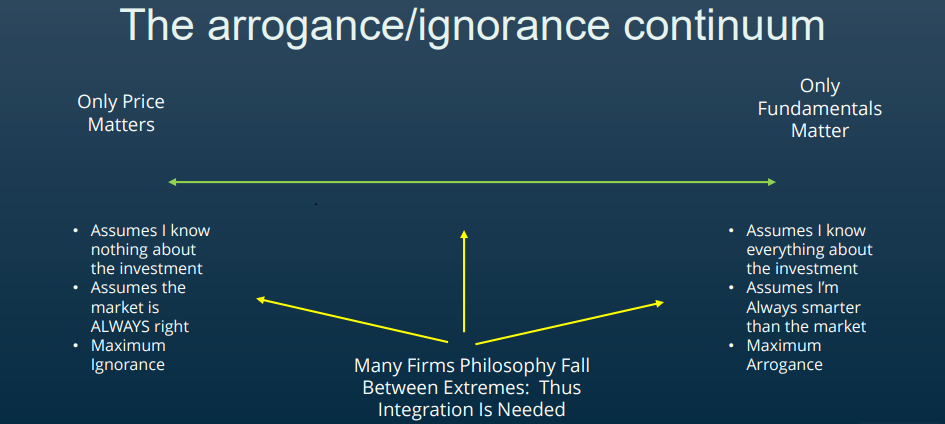

You have those who assume the market is always right, and that only price matters ('the ignorant') and those who believe they are smarter than the market and that only fundamentals matter ('the arrogant'). We believe you need multi-disciplines where fundamentals overlap the behaviour biases - you need an integration of ignorance and arrogance.

Over time you learn that knowledge comes from experience... but not all knowledge is equal. This is best explained by defining the difference between information and knowledge, which are not the same thing, as information comes from the outside and knowledge is born on the inside. For example: When you tell a young child that the stove is hot, this is information. But it is not until they touch the hot stove, despite having the information, that they have the knowledge.

Information can be wrong, or you could be misinformed, and knowledge can be subjective or biased. So where does this leave us for making investment decisions?

Understanding ignorance and arrogance and the integration which is needed to bridge the divide is of utmost importance in creating a diversified portfolio. Why argue for each extreme when you can manage risk more efficiently by combining active investments with thematic ETFs' that provide exposure to exponential opportunities and market alternative hedging.

How a person thinks may be more important than what a person thinks.