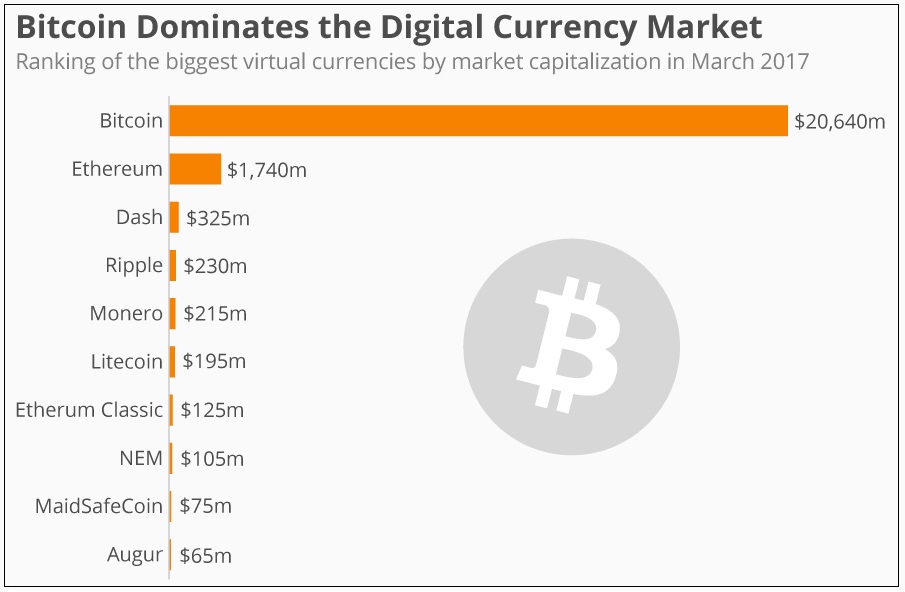

The list of digital currencies available today is well over one hundred and growing, so for this article, we will be using Bitcoin as an example, due to its presently massive market share.

Top six digital currencies other than Bitcoin: Litecoin, Ethereum, Zcash, Dash, Ripple, and Monero.

Bitcoin is a form of digital currency, created and held electronically. No one controls it. Bitcoins are not printed, like dollars or euros - they are produced by people, and increasingly businesses, running computers all around the world, using software that solves mathematical problems. Digital Currency is the first example of a growing category of money known as cryptocurrency.

What makes it different from standard currencies?

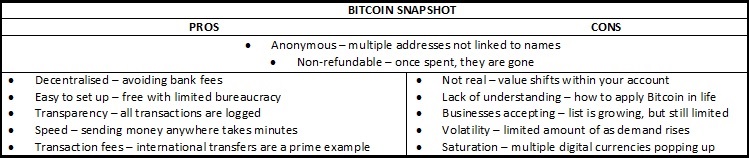

Bitcoin can be used to buy things electronically. In that sense, it is like conventional dollars, euros, or yen, which are also traded digitally. However, Bitcoin's most important characteristic and the thing that makes it different to conventional money is that it is decentralised - where physical currency draws value from the full faith and credit of the issuing government. No single institution controls the Bitcoin network. A fact that puts some people at ease because it means a large bank cannot monitor their money. This fact also brings some to discontent, because digital currency can, and has been used to purchase and launder money for criminal gain.

Are they unlimited? What are miners? How does it work?

Bitcoins are not unlimited. The bitcoin protocol - rules that make Bitcoin work - say that miners can create only 21 million bitcoins. Miners monitor and verify digital currency transactions, being paid in newly generated Bitcoins. However, these coins can divide into smaller parts, the lowest divisible amount is one hundred millionth of a bitcoin and is called a ‘Satoshi', after the founder of Bitcoin: Satoshi Nakamoto.

Will everyone accept digital currency?

Not necessarily. A prime example would be China, a major player in the world economy. Bitcoin had experienced a drop of $500 as of September 11, 2017, when China banned the cryptocurrency on exchanges. China will also be adding two of their own digital currency into the mix with OKCoin and Huobi, increasing the saturation of existing choices. Russia is said to be following suit, but the details on this are still unclear.

The conventional currency middles on gold or silver. Yet, Bitcoin is not based on gold; it relies on mathematics. Around the world, people are using software programs that follow a mathematical formula to produce bitcoins. The mathematical formula is freely available so that anyone can check it. The software is also open source, meaning that anyone can look at it to make sure that it does what it is supposed to.

Speculation:

- China has declared major digital currencies illegal but has approved those created in China.

- Additional countries may follow suit with China in developing their own digital currencies while making others illegal.

- Blockchain* technology currently provides a decentralised database. Banks are beginning to use digital currencies with a Blockchain they can regulate and control for a profit, such as Ripple.

- Will digital currency follow the traditional course of physical currency where the value changes relative to each other, in theory, based on purchasing power changing in supply and demand?

- If currencies have value simply because of the faith in the issuing government, why can't Bitcoin or other digital currencies?

- Will financial institutions cede to Bitcoin or create their own digital currency? Alternatively, will large companies such as Google or Amazon begin to make their own digital currency? Which of these new and existing currencies will survive?

- Is no price too high to pay?

*Blockchain: a digital ledger in which transactions made in Bitcoin or another cryptocurrency are recorded chronologically and publicly.

Bottom line

None of these speculations can be answered with absolution, yet.

However, we know there is always a price too high.

Source: statista, coinreport, coindesk, financial post