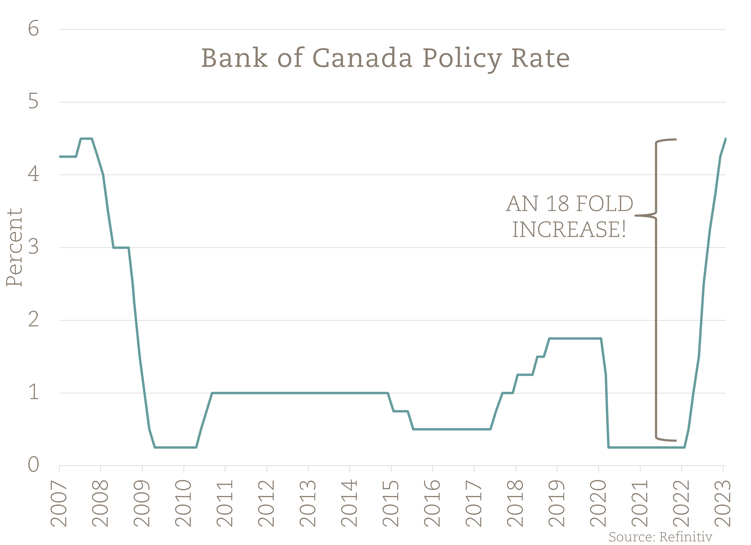

Over the last year and a half, we have experienced one of the fastest upward revisions of interest rates in a lifetime. Never has the Bank of Canada’s Policy Rate increased from effectively nothing to 4.5% in one year, the most aggressive economic tightening in decades. While most of the attention is given to the impact on asset prices (fixed income, equities, and housing) and debt costs, there are also more intricate impacts to a higher-rate environment – which are positive!

Over the last decade, savers have been one of the groups most punished by the low-interest rate regime. Due to either low-risk tolerance or a short investment horizon, they were largely left behind while equity markets soared. Interest rates on savings accounts during the last decade were practically nothing and in real terms, savers were falling behind as inflation ate away at their purchasing power. Many savers felt pressured to move into more risky assets like equities or high yield junk bonds to achieve a positive real return as both investment grade fixed-income yields and savings account rates were at record lows.

The current normalizing rate environment is hugely positive for both savers and risk-averse investors. Savings account interest rates have increased dramatically over the last year. Risk-free assets, such as Canadian GICS, have been offering up to 5% in the short-term, a stark contrast to the low of 0.5% that we saw after the Financial Crisis. Government and investment-grade corporate bonds have also seen yields rise further benefitting the risk-averse investor and providing more options for portfolios to generate income.

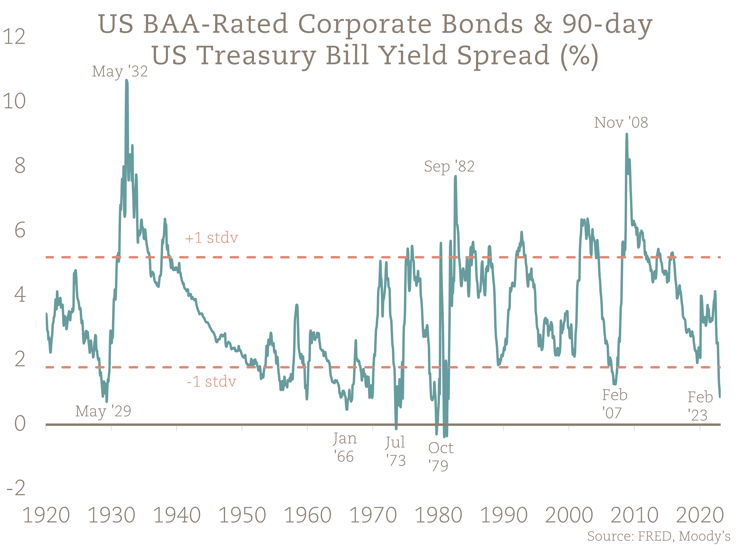

Over the last year short-term government rates have increased much faster relative to investment grade corporate bonds. We have observed one of the steepest declines in spreads between the two yields in over a decade and the lowest spread in yields since the early 1980s. What this means is that the higher yield that you would receive from investing in a riskier corporate bond relative to something like a GIC has declined dramatically. The historically low spread between the two means that you get a similar yield for much less risk making the sure bet much more appealing than it has been in decades.

The knock-on-impacts and financial repression of the record low-interest rates can be seen everywhere.

Let’s take condominiums as an example. One of the largest complaints about condominium or apartment living is the constantly growing fees used for maintenance and upkeep of the buildings and property. For years, condo fees have been creeping up as the cost of providing services, such as landscaping or maintenance have increased while the income generated from their reserve accounts declined alongside falling rates.

Condo regulations tend to favor saving over investment and the preservation of capital and liquidity is key when making investment decisions. As such, condo boards tend to be savers or fixed-income investors rather than equity investors. Due to the low-interest rates of the last decade fixed income yields have generally been lower than the increase in costs associated with condo upkeep leading to the continued growth of condo fees to make up the difference.

With interest rates increasing toward a more normal level, fixed-income yields and interest in savings accounts are creating higher returns for savers and risk-averse investors – something absent for way too long.

Bottom Line

Due to the duration of the low-interest rate regime, many people have forgotten that there are actual benefits that come along with interest rate normalization. Record low rates created financial repression. Isn’t it lovely to log into your bank account and see an interest payment again?