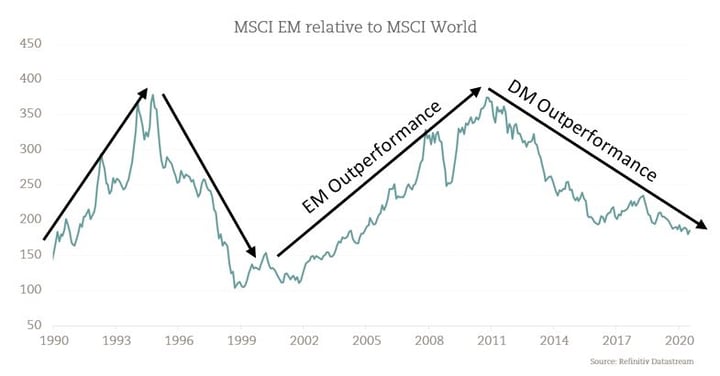

It is no surprise that developed markets have been outperforming emerging for a long time now.

The ten largest stocks in the world by market capitalization are US companies. The cycle of developed market (DM) vs. emerging market(EM) performance is a long-term cycle that lasts on average seven-to-nine years.

While emerging markets have been in a nine-year bear market since their 2011 top, the tides are turning. If the pattern repeats, then when the cycle turns upwards, emerging markets could outperform for the next seven-to-nine years. Asian multinationals, like China's Huawei and India's Tata, have already materialized in this century, and more are expected to appear on the global scene.

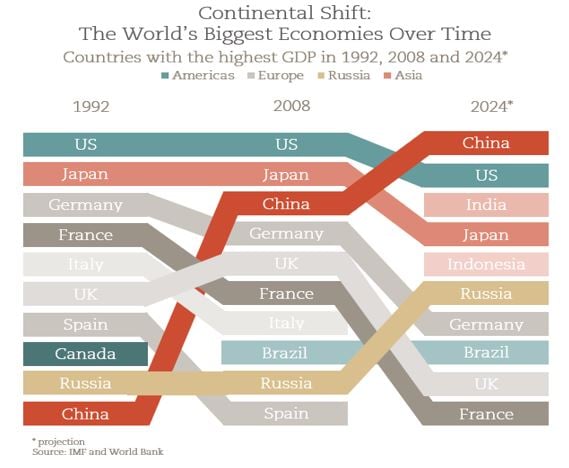

Shifts of the World's Biggest Economies

Asian countries are forecasted to make up three of the top five countries in the world (by the size of GDP) in 2024, according to the World Bank and International Monetary Fund. Reasons include; superior demographics, the rise of their middle class and, most recently, increased home country bias due to trade restrictions.

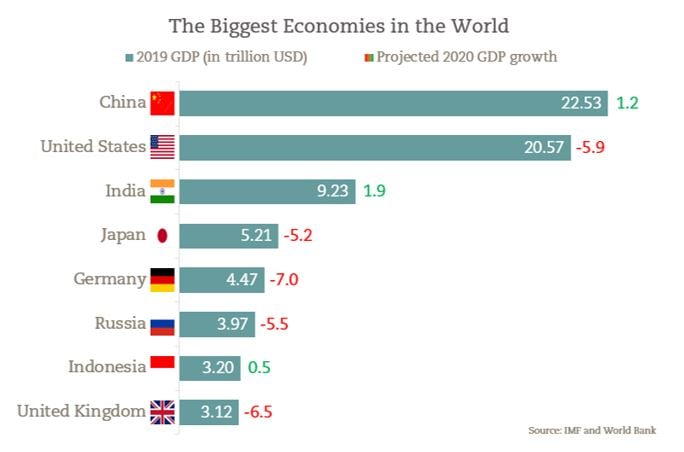

The International Monetary Fund projects that due to the Coronavirus Pandemic that only three of the eight largest economies will grow this year, all of which are Asian.

Bottom line

The changing nature of global growth reinforces the importance of global equity investing. Global investing opens a broader opportunity set to find the best ideas anywhere in the world, regardless of region, country of domicile or constraints of narrower investment mandates.

Having a portfolio that can access growth irrespective of its location enables SANDSTONE to invest in companies that are real drivers of innovation and value creation for the next decade.