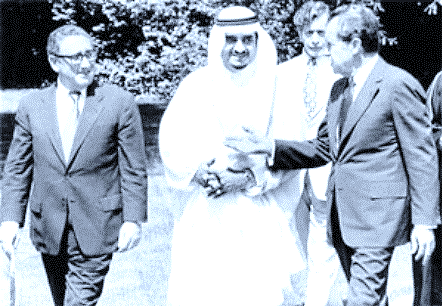

The dollar was pegged at $35 an ounce, and freely exchangeable into gold at that rate. However, by 1971, convertibility into gold was no longer viable as America's gold resources drained away. Instead, the dollar became a pure fiat currency (decoupled from any physical store of value), until the Petrodollar Agreement was concluded by President Richard Nixon and Secretary of State Henry Kissinger in 1973.

The essence of the deal was that the U.S. would agree to military sales and defence of Saudi Arabia in return for all oil trade being denominated in U.S. dollars. A secondary option to this agreement is the purchase of U.S. debt securities with surplus oil proceeds. By 1975, all OPEC nations agreed to price their oil supplies exclusively in U.S. dollars and to hold their oil proceeds in U.S. government debt securities.

As a result of this agreement, the U.S. dollar then became the only medium in which energy exchange could be transacted. This underpinned its reserve currency status through the need for foreign governments to hold U.S. dollars, recirculate the dollar cost of oil back into the U.S. financial system, and make the dollar effectively convertible into barrels of oil. Moreover, the U.S. dollar was moved from a gold standard onto a crude oil standard.

Since 1973, countries had to hold U.S. currency to purchase commodities (i.e. oil). This encouraged the purchase of U.S. debt securities with U.S. cash reserves - a strategic system that created a continuous demand for the U.S. dollar.

- The Saudis agreed to price all of their oil sales in U.S. dollars only.

- The Saudis would invest their surplus oil proceeds in U.S. debt securities.

- The U.S would provide arms and a security guarantee to Saudi Arabia.

If you would like to know more about our thoughts on this from our OUTLOOK 2018 presentation you can request a copy of our booklet.