At OUTLOOK 2023 one of our major trends for the year ahead was the reopening of the Chinese economy. The country’s zero-COVID policies have been easing over the last few months and the rapid reopening has meant that the world’s second-largest economy is finally back to business. Lockdowns had hampered the growth of the Chinese economy drastically only growing 3% for the full year of 2022, the second slowest growth rate realized by the country since 1976.

IMF projections for China’s GDP growth for 2023 rose sharply from 4.4% to 5.2% on the back of the release of pent-up business and consumer demand. When Western countries opened their economies following their COVID shutdowns there was a remarkable increase in spending, demand, and equity market appreciation. China’s reopening story is expected to be similar, bolstered by consumers and businesses looking to resume their daily activities. For Chinese consumers, this means putting their record savings to good use through increased discretionary spending and travel. For businesses, this means resuming operations at scale and continued investment in growth.

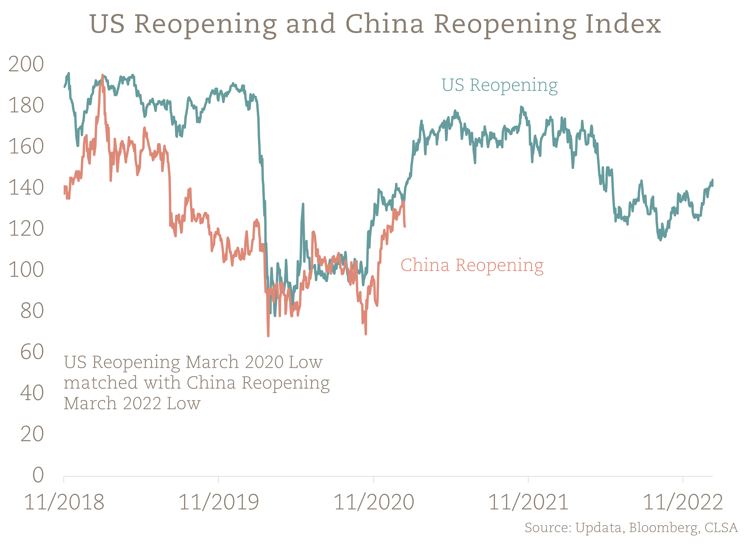

In markets, China’s Reopening Index mimics the movement of the US Reopening Index just two years apart. This has profound implications for our strategic positioning in the coming year as we aim to capitalize on the higher growth of the Chinese economy, the return of a wealthier Chinese consumer, and businesses looking to ramp up to full production.

eUROPEAN EXPOSURE

Supply chain security has become a central theme of business operations over the last few years due to an increase in geopolitical trade risks and supply chain instability. With the increasing tension between the US and China many Chinese and US businesses are looking at the prospect of altering supply chains and European companies could benefit from these trends. With the renewed focus on trade and supply chain security, European corporations have a geographic advantage.

European travel and discretionary equities are also anticipated to benefit from China’s reopening as prior to the pandemic China was the world's largest outbound tourist market. With the return of tourists airlines, hotels, and even luxury goods are anticipated to benefit. The Chinese luxury goods market declined 10% in 2022 due to stringent zero-COVID policies but is anticipated to recover to 2021 levels by the end of the year. European luxury brands, such as Louis Vuitton or Hermes, are one of the many potential ways to indirectly gain exposure to the Chinese reopening narrative focused on a rebound in consumer sentiment.

asian exposure

Emerging markets and China’s close neighbours are also anticipated beneficiaries of the reopening through both tourism and strong business ties. For example, Thailand and Singapore are major destinations for Chinese tourists and in Thailand alone, Chinese tourists account for a quarter of the country’s annual visitors. Currencies in the tourism-driven markets are also expected to appreciate as Chinese tourists increase demand for destination currencies to use for discretionary spending, transportation, and lodgings.

China is the largest trading partner of many Asian nations such as Japan, Taiwan, and Vietnam. These countries are anticipated to benefit from China’s reopening as businesses address shortages of materials and other specialized goods. For instance, Japan makes much of the high-quality and finished goods that Chinese businesses and infrastructure projects need to operate effectively. These include heavy machinery, tools, automobiles, high-end steel, and chemicals.

Our strategic focus in Asia has been in countries and sectors which we believe will benefit both directly and indirectly from China’s reopening. Nations like Japan, Vietnam, and Singapore are investor friendly and allow us to gain crucial exposure to Asia’s economic growth engine.

COMMODITIES

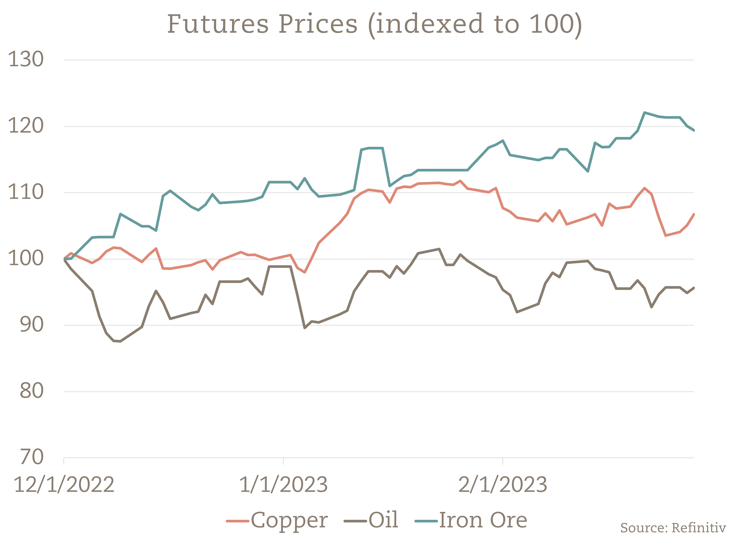

China’s real estate recovery, renewable energy infrastructure buildout, and their push to electric vehicles all play a role on the demand side for hard commodities like iron and copper. Iron ore and copper have been some of the biggest beneficiaries of China’s reopening with prices increasing nearly 20% and 7% respectively from December to the end of February. China is also the world’s second-largest consumer of oil and with the recovery of commuting, travel, and business there is expected to be meaningful short-term demand for crude oil and its derivatives. Our strategic commodities focus has been on diversified metals and fully integrated energy companies which are anticipated to benefit from rising commodity prices and higher infrastructure spending.

Bottom Line

At OUTLOOK 2023 one of our major trends for the year ahead was the reopening of China. Our focus is on key sectors and geographic markets which we anticipate will benefit from the resumption of business and the return of a strong Chinese consumer.