Click here for the complete Canada 2018 Budget

Holding Passive Investments Inside a Private Corporation

In October 2017, the Government announced it would lower taxes on small businesses from 10.5 percent to 9 percent by 2019 while making sure the small business tax rate was not being used to gain a personal tax advantage for a very small number of wealthy individuals.

Corporate income is taxed at lower rates than personal income to provide businesses with more money to invest, grow and create jobs. Currently, however, some wealthy corporate owners can gain significant tax advantages by holding corporate income inside their corporation for personal savings purposes. Action is needed to ensure that the tax system encourages corporate owners to use low corporate tax rates to support their business, not for significant personal tax advantages.

The Government has engaged Canadians in an open dialogue on tax planning strategies using private corporations and has listened to their feedback. With respect to efforts to limit the benefits of passive investments held within private corporations, in October 2017 the Government committed that, in any changes it would make, it would ensure that:

- Passive investments already made by private corporations' owners, including the future income earned from such investments, are protected;

- Going forward, a $50,000 threshold on passive income in a year (equivalent to $1 million in savings, based on a nominal 5-per-cent rate of return) would be available to provide more flexibility for business owners to hold savings for multiple purposes, including savings that can later be used for personal benefits such as sick leave, maternity or parental leave, or retirement; and

- Incentives would be maintained such that Canada's venture capital and angel investors can continue to invest in the next generation of Canadian innovation.

During the period of consultation, the Government heard that its proposals could be very complex and add significant burdens on businesses. Consistent with the Government's outlined principles, and consistent with the helpful contributions of many Canadians in the consultation period, the Government proposes two new measures to limit deferral advantages from holding passive savings in a corporation, but in a more targeted and simpler manner than was proposed in July 2017.

Limiting Access to the Small Business Tax Rate to Small Businesses

The first measure proposes to limit the ability of businesses with significant passive savings to benefit from the preferential small business rate. The current small business deduction limit allows for up to $500,000 of active business income to be subject to the lower small business tax rate. Access to the lower tax rate is phased out on a straight-line basis for associated Canadian-controlled private corporations (CCPCs) having between $10 million and $15 million of aggregate taxable capital employed in Canada.

In the consultation, many tax experts and advisors suggested that the main reason for the use of private corporations as a tax planning tool was the significant difference between personal tax rates and the low small business tax rate. Rather than remove access to the refundable taxes as proposed in July 2017, an alternative proposed approach is instead to gradually reduce access to the small business tax rate for corporations that have significant passive investment income. Such an approach would reinforce the principle that the small business rate is targeted to support small businesses, which tend to have more difficulty accessing capital, so they can re-invest in their active business, not accumulate a large amount of passive savings.

Consistent with this principle, Budget 2018 proposes to introduce an additional eligibility mechanism for the small business deduction, based on the corporation's passive investment income.

Under the proposal, if a corporation and its associated corporations earn more than $50,000 of passive investment income in a given year, the amount of income eligible for the small business tax rate would be gradually reduced. For the limited number of corporations earning that level of passive income, their corporation's active business income would potentially be taxed at the general corporate income tax rate.

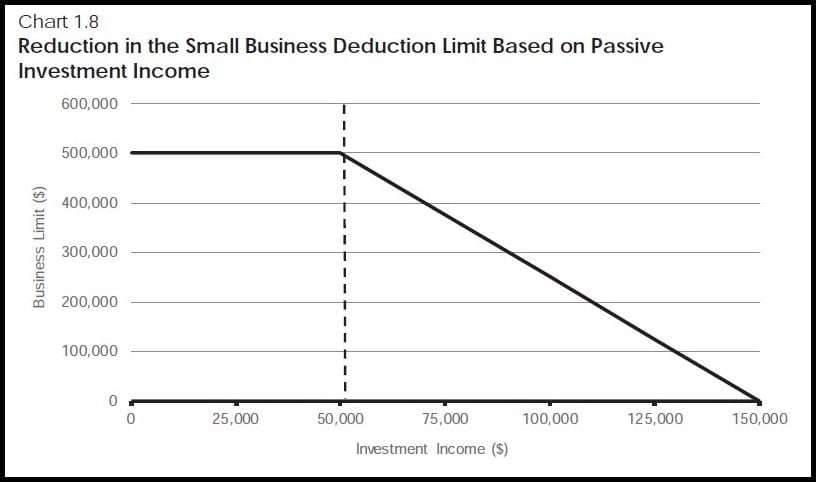

It is proposed that the small business deduction limit be reduced by $5 for every $1 of investment income above the $50,000 threshold (equivalent to $1 million in passive investment assets at a 5-percent return), such that the business limit would be reduced to zero at $150,000 of investment income (equivalent to $3 million in passive investment assets at a 5-percent return).

The proposal represents an important departure from the July approach. Importantly, the design does not directly affect taxes on passive investment income. Under this proposal, the tax applicable to investment income remains unchanged-refundable taxes and dividend tax rates will remain the same, unlike the July 2017 proposal. No existing savings will face any additional tax upon withdrawal, thereby maintaining the Government's commitment to protect the tax treatment of all past savings and investments.

The new approach will be much simpler to comply with, will not require the tracking of new and legacy pools of passive investments, and will target only private corporations with more than $50,000 in passive investment income per year or approximately $1 million in passive investment assets (assuming an average 5-percent return).

Furthermore, capital gains realized from the sale of active investments or investment income incidental to the business (e.g., interest on short-term deposits held for operational purposes) will not be taken into account in the measurement of passive investment income for purposes of this measure. With the proposed approach, incentives will be maintained such that Canada's venture capital and angel investors can continue to invest in Canadian innovation.

Limiting Access to Refundable Taxes for Larger CCPCs

The second measure will limit tax advantages that larger CCPCs can obtain by accessing refundable taxes on the distribution of certain dividends.

The tax system is designed to tax investment income earned by private corporations at a higher rate, roughly equivalent to the top personal income tax rate, and to refund a portion of that tax when investment income is paid out to shareholders.

In practice, however, any taxable dividends paid by a private corporation can trigger a refund of taxes paid on investment income, regardless of the source of that dividend (i.e., whether coming from investment income or lower-taxed active business income).

This means that larger CCPCs can pay out lower-taxed dividends from their pool of active income taxed at the general corporate rate, and still claim a refund of taxes paid on their investment income which is intended to be taxed at higher tax rates. This can provide a significant tax advantage. Budget 2018 proposes that CCPCs no longer be able to obtain refunds of taxes paid on investment income while distributing dividends from income taxed at the general corporate rate. Refunds will continue to be available when investment income is paid out.

Targeting the Impact of Passive Investment Changes

In total, Budget 2018's proposals on passive investments are targeted-less than 3 percent of CCPCs will be affected, approximately 50,000 private corporations.

Overall, more than 90 percent of the tax revenues from the two measures would be generated from corporations whose owners' household income is in the top 1 percent of the income distribution. Owners below the top 1-percent threshold whose corporations are affected by the measures would nevertheless typically have significant accumulated wealth.

The two measures will apply to taxation years that begin after 2018.

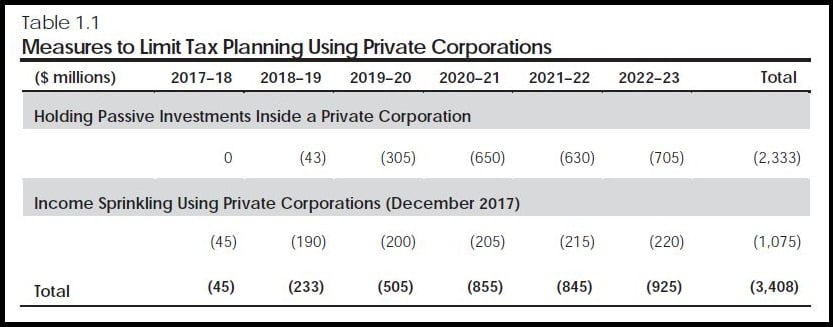

In total, inclusive of the Government's changes to income sprinkling rules, the Government expects to raise from these measures $925 million per year by 2022-23.

How These Changes May Affect Businesses That Hold Passive Investments

Elise owns a catering business. Her corporation earns $100,000 (after tax) in business income each year and pays out $75,000 as dividends to cover Elise's living expenses. She saves the other $25,000 in each of the next three years to build up a fund for her planned parental leave. Elise will not be affected by the new rules because the investment income on her savings will be well below the $50,000 threshold, and she does not earn business income taxed at the general corporate rate.

Simon is an incorporated farmer. Whenever possible, he puts aside excess income to manage weather and other risks affecting his livelihood. His goal is to save $500,000. He chooses to save through his corporation in the AgriInvest program to take advantage of matching government contributions. Investment income from AgriInvest is not considered passive income. As such, Simon will not be affected by the new rules.

Claire launched a successful retail business and now uses the retained earnings in her corporation to invest in promising start-ups. She sold her 20-per-cent stake in a growing clean-tech firm, and realized a $1 million capital gain, which she reinvested into two new start-ups. Claire will not be affected by the new rules because her ownership stake in this active business is such that her capital gain will not count towards the $50,000 threshold, and she is actively reinvesting.

Amrita owns a hotel. Her income depends on a number of factors outside her control, so she sets aside funds each year to ensure she can continue to pay salaries and expenses in case of a downturn. She has $400,000 in savings in her corporation that she invests in lowrisk bonds. Amrita will not be affected by the new rules because the investment income on her savings will be well below the $50,000 threshold, and she does not earn business income taxed at the general corporate rate.

Saanvi owns a retail store and keeps cash deposits to pay her suppliers and the salary of her employee. She earns interest income on these deposits, which in her circumstances is considered incidental to her business. As a result, Saanvi will not be affected by the new rules.

Louis owns a very profitable private corporation that earns more than $500,000 annually. He has accumulated a portfolio with a value of $5 million, which he intends to pass on to his children. Given his level of savings and level of income, Louis will no longer receive the benefit of the small business rate to fund further passive investments, starting in 2019. All of his business' income will be taxed at the general corporate rate.