Roughly every decade, financial markets fall in love with a new narrative. Typically, the new narrative is something simple such as:

1) the opening of new markets

2) technology breakthroughs

3) the fear of scarcity

- OUTLOOK Booklet 2023

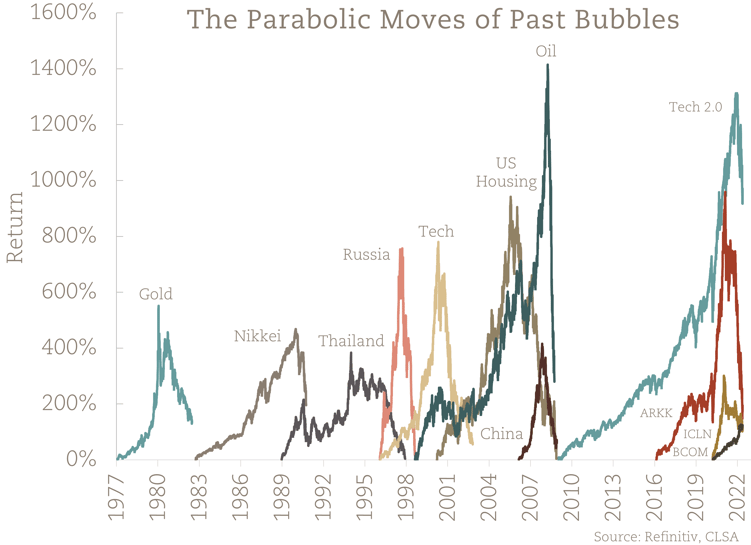

When the market falls in love with a new narrative there are always significant winners and losers. The increase in prices of equities or markets at the center of the new narrative can be parabolic with investors concentrating on one area. When the narrative begins to show signs of weakness investors quickly change their taste, and the reversal downward is far more sudden.

In this sense, the charts for these market bubbles most similarly resemble stairs on the way up and elevators on the way down.

The final move higher is typically the steepest as excitement around the narrative is at its peak. Fear-of-missing-out (FOMO) builds up and investors pile into already overly concentrated positions based on dated narratives leading to further unreasonable increases in equity prices. FOMO investors entering already concentrated trades explains the parabolic shape found in bubbles before they burst.

Let’s look at the parabolic move in US tech dubbed Tech 2.0. This rally started in 2009 and is the longest and second biggest in history.

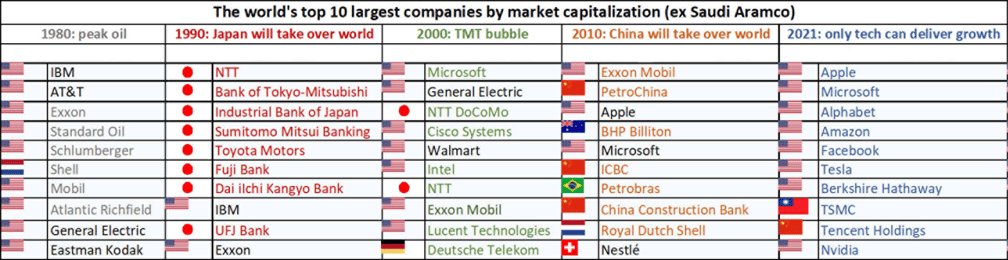

One of the notable characteristics of market leadership during a bubble is that those companies do not remain the market leaders of subsequent bubbles. Nations such as Japan and Thailand were at the center of market narratives in the 80s and 90s due to relaxed central banking policies and higher growth compared to other national economies. Each market became overvalued due to the flood of investment and when tailwinds turned into headwinds the narrative changed and valuations plunged. Both Thailand and Japan have been out of favor with most investors for decades after their peaks.

The companies involved in the Dot-com Bubble benefitted on the back of speculation around the growth of internet technologies and computing adoption. Companies like Cisco, Intel, and Lucent Technologies were some of the largest companies by market cap during that decade and have since fallen out of favor with investors. The companies that participated in the second tech rally (Tech 2.0) were fundamentally different from those caught up in the Dot-com Bubble.

Tech 2.0 took advantage of lower interest rates to fuel growth and acquisitions with valuations increasing substantially based on astronomical expectations of a platforms potential market. It was not until a few years ago that large tech company valuations had become unreasonable in the face of increased platform competition. Even with the increased competition between platforms, record layoffs and much higher costs of capital, investors are still focused on the narrative that the FAANGS can still provide the perpetual growth that they once did.

Bottom Line

Recency bias and the dominance of the Developed Market over the last decade is the main reason investors are still hyper-focused on the FAANGs. Sometimes investors forget that money has no memory. Above all, it comes down to what you pay. An example we used at OUTLOOK 2023 was that for the same value as Apple, you could purchase the world’s 100 most valuable mining companies, three years of global copper production, and all the seaborne iron ore transported in 2022. So, which side of that deal would you take? Are you still drawn to the narratives of the past decade, or do you believe that there is another narrative out there waiting to be discovered? OUTLOOK 2023 ended with a succinct message that highlighted the way we view investing and the way we’d answer those questions.

“Don’t look back. You aren’t going that way.”