The European Union (EU) has had its share of lousy coverage over the past decade, including a sovereign debt crisis and political instability of Brexit. But has the COVID-19 pandemic reunited the region?

The EU's Structural Shift

There has been a truly fundamental shift in the EU's approach that has grown out of the pandemic. The European Commission has agreed on a joint €750 billion recovery plan, described as its most divisive in years. The program includes €390 billion in grants to struggling countries within the bloc, with the rest available as loans. It will be financed by issuing joint debt backed by the EU budget and distributed based on need. By agreeing to issue common debt in 30-year and 50-year maturities, EU creditor nations are signalling full confidence in the future of the union.

Germany's shift towards eurozone protector, rather than fiscal rule enforcer, is the most prominent effort of cross-border solidarity. The EU is sending a strong signal of internal cohesion, exactly the fiscal coordination investors have waited for. The union's new cohesion should displace doubts about the euro's durability and future.

Rising Budget and Single Market Structure

The EU budget is expected to rise for the first time since 1988. The budget cap, a potent symbol of stalled political integration, is now removed, and the union is investing in their united future.

Germany has acknowledged its export-focused development model is unsustainable. Increased global trade frictions (i.e. the UK and the US) along with sanctions and tariffs have spurred localization – re-energizing reforms focused on completing Europe's single market. The single market structure promises tariff relief and allows the free movement between countries for employment/talent and commerce.

The EU is one of the three most significant players in international trade, behind only the US and ranking ahead of China in 2019. The EU's total economic output (by Nominal GDP in USD) totalled $15.6 trillion last year. Interesting to note that over 64% of its total trade is done with other countries in the bloc – making it the biggest free trade market. The EU has achieved an economy of scale that eats into the comparative advantage the US has traditionally enjoyed as a large market.

If Europe can boost economic growth through its single market structure, it will attract capital investment and cause the euro to rise structurally.

The Eurozone Market is Cheap in Comparison

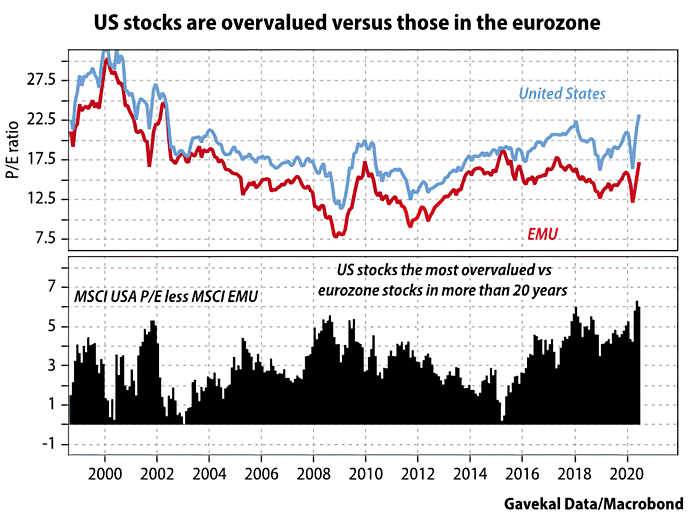

The eurozone has underperformed due to its lack of cohesive action and policies, both of which are changing. Eurozone stocks are more undervalued when compared to US stocks than at any time in the past 20 years.

The EU's new cohesive action and policies should aid a domestically driven recovery across the eurozone – renewing confidence. It should reduce the chance of any political backlash against the euro and lessen the eurozone risk premium reducing the valuation spread with the US. This combination of a favourable macro tailwind and attractive valuations makes euro assets attractive.

Bottom Line

The EU managed to beat back the virus (after some members were hit hard), protect their economies (within their borders) and lay the ground for a putative fiscal union.

The changing macroeconomic environment should favour both a strong euro and domestically focused equities. We believe the EU market is a fruitful area for investment opportunities long-term. The market's depth and breadth, along with its regional variations, provide plenty of choices for investments.

Sandstone currently has portfolio exposure to Europe through companies residing in both France and the Netherlands.