The Past Decade

The last decade has been transformational in many ways:

- Disruptive Technology: Technology has become a game-changer in everything from the markets to elections, business development to medicine. Monopolistic companies have transpired, centralizing both data and innovation.

- Deleveraging: The deleveraging that needed to happen after the financial crisis didn’t happen. Now, in some cases, both government and corporations have staggering debt.

- Growth of Emerging Markets: The rise of China 2025, the One Belt One Road initiative and the increased standard of living in the area have propelled a rise in the middle class. Emerging markets now want a better seat at the table for global order.

The Next Decade

In the next decade, globalization, connectivity, and demographics will have the most profound effects globally.

- Has globalization peaked? We are ending an era of cooperation and entering an era of competition. Growth of emerging markets, the weaponization of reserve currency and disruptive technology are all contributing factors in a battle for global supremacy between the US and China. And Canada is stuck in the middle. The labour cost arbitrage that drove globalization in the past is no more. Now a new global-local is arising where global companies are focusing operations in local markets they see as lucrative.

- Connectivity to the max. 5th generation (5G) wireless networks will provide the connectivity necessary to enable the mega-trends of the next decade. The data that's been collected over the last 10 years will finally be unlocked with AI and machine learning. Unlocking big data, decentralization and the move towards cashless societies will transform business across every sector and the economy.

- The domino effect of demographics. For the first time ever, the elderly will outnumber the young globally. Many countries are already facing fiscal and political pressure regarding public systems of healthcare, pensions and social protections for an ageing population. Technology will play a large role in helping countries deal with many of the logistical problems that arise from this shift. And technology could also play a large role in helping people - think ageing in place.

2019 Investment Strategy

In this time of geopolitical uncertainty, balancing risk is everything. But balancing risk doesn't mean the 60/40 of your grandfather's portfolio. That allotment simply doesn't work in this low interest rate world. Balancing risk moving forward will require balancing themes, asset classes, currencies, and market alternatives - and keeping a global focus will be paramount.

For more detail, request a copy of OUTLOOK 2019.

“Sandstone’s perspective always provides very useful input in developing our views of the business environment ahead. ”

Mary Lou Halliwell

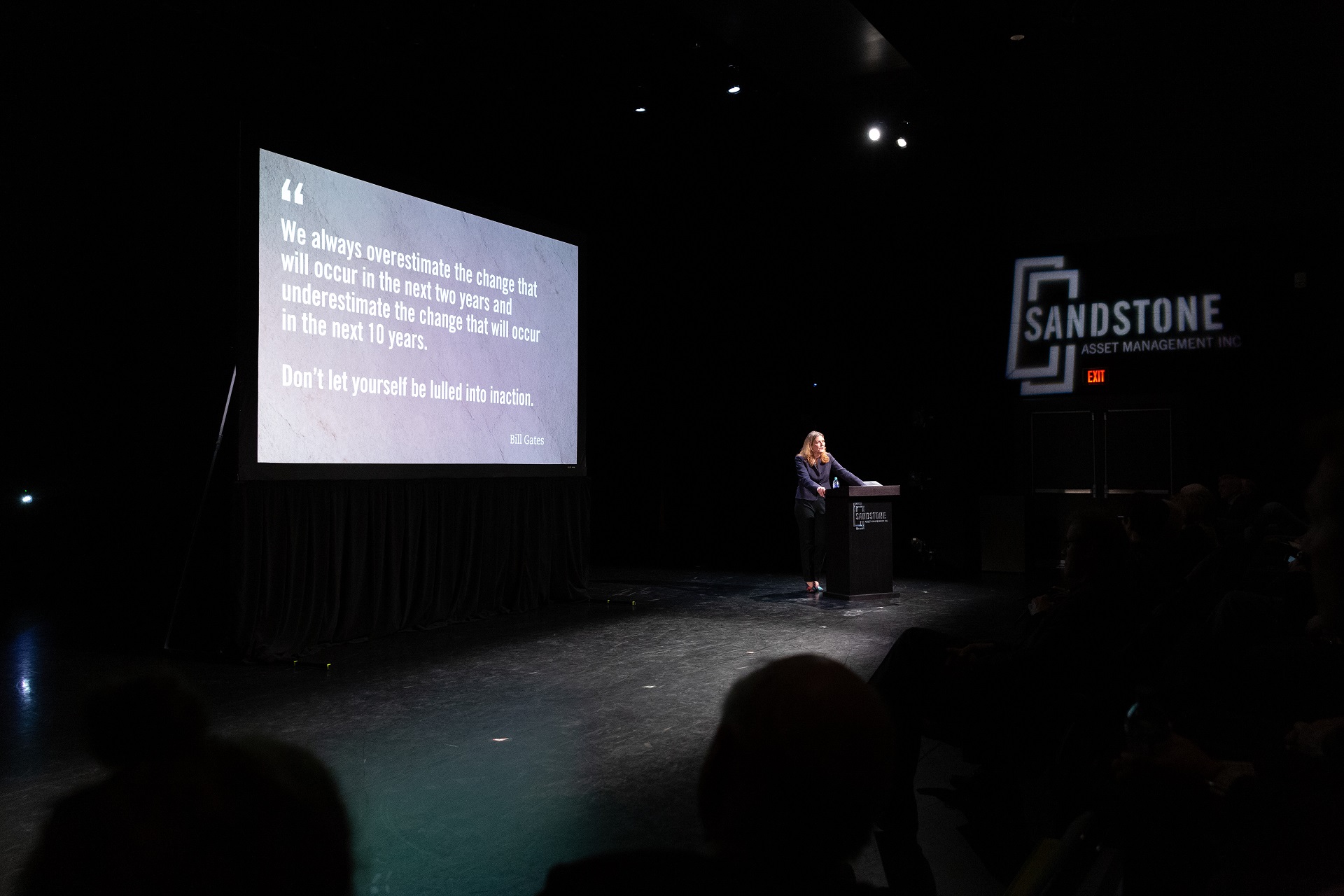

Photos from the event