Global chip shortages, supply chain disruption and mounting geopolitical tensions have made Taiwan Semiconductor Manufacturing Company (TSMC) possibly one of the most important companies in the world that few people have heard of.

Sandstone introduced SAMI the sensor at OUTLOOK 2014 with the following thoughts “Sensors make cents. Sensors enjoy a starring role in the five forces of context: mobile, social media, data, sensors and location. They are the critical building blocks for future technological advancement and applications and are the foundation for the age of context”. Since 2014, we have continually been invested in the industry with our most recent position TSMC being initiated in April 2020.

Chips are the eyes, ears and hands of our electronic system – a crucial part of today's technology in all industries. Without chips, vehicles, phones, energy-efficient technologies, and processors powering supercomputers to the heat-resistant chips in missiles themselves would all grind to a halt and future advances would stagnate.

TSMC is at the forefront of manufacturing chips and is one of the largest and most technologically advanced foundries globally. The company has long gone largely unnoticed because the semiconductors it manufactures are designed and sold in products by branded vendors such as Apple, AMD or Qualcomm to name a few. Yet the company controls more than half of the world market for made-to-order chips and supplies to all regions of the world.

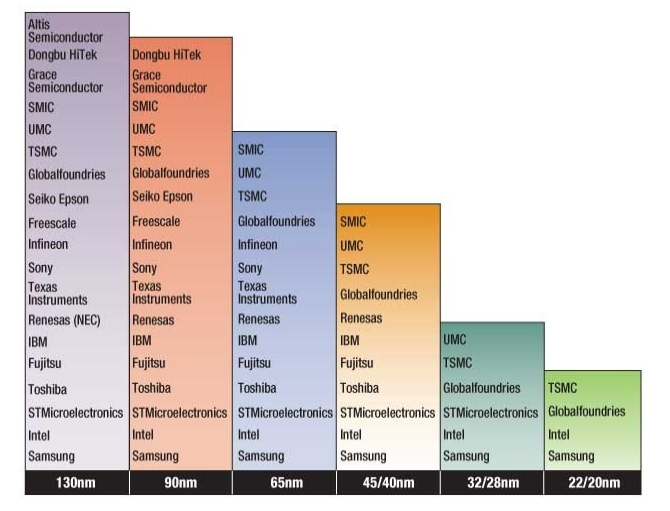

The industry is incredibly dependent on TSMC due to its sophisticated technology and sheer size. Twenty years ago, there were 20 foundries, now four large ones are remaining (as per the chart below). Today, the most cutting-edge facility is sitting on a single campus in Taiwan.

Chip companies internationally have allocated their capital to design and left production to dedicated foundries such as TSMC. The more chipmakers outsourced to pure-play foundry companies, the harder it was for new companies to enter the space and foundries had to continually advance to stay in the race. This created a vacuum for TSMC as they invested in developing (patented) technology to reduce the size of customer chip designs. The smaller the size the better the energy efficiency and fewer design constraints for the end product.

European chipmakers like Infineon, NXP and STMicro have long focused their attention on chip design, not production. Several of Europe’s largest chip companies retain some fabrication units, but they have avoided investing billions in new capacity and outsourced a lot of production to foundries. Therefore, Europe’s chip capacity lags several generations of process technology behind industry leaders like TSMC and Samsung.

There are only a few foundries that have kept up with the industry’s technological advancements:

- Taiwan's Taiwan Semiconductor Manufacturing Company (TSMC)

- South Korea’s Samsung Electronics

- China’s Semiconductor Manufacturing International Corporation (SMIC)

- And the US’ Intel

Mounting geopolitical tensions between the US and China are now interfering with chip supply chains globally. Also, worth mentioning is the historical and current importance of Taiwan to both China and the US. Taiwan is at the center of today's geological tensions due to its location, history and chip manufacturing.

SMIC, China’s largest foundry, is now hampered by the US decision last year to use export controls to bar it from receiving equipment needed for building cutting-edge chip production facilities.

The US is providing grants and pressuring foundry companies to create manufacturing capacity within its borders, for national security.

Intel recently announced that it was setting up a dedicated foundry business and will invest $20bn in two new fabs in Arizona. Some industry experts are skeptical of the company’s success – they tried this a few years ago and could not keep up with technology advancements.

Last year, TSMC committed to investing in the US as a result of long-term efforts by the Pentagon to recreate some advanced chip manufacturing capacity for a secure defence supply chain.

Bottom line

TSMC is possibly one of the most important companies in the world. And, while it has remained rather non-newsworthy, its dominant position is beginning to draw international attention. TSMC will not yield easily. With its huge capital investment plans for this year and next, the company has already signaled that it is determined to hold on to its lead.