A nation's currency is cyclical in terms of its economic impacts. Think of it this way, a strong domestic currency creates:

- Cheaper imports; benefitting the consumer.

- More expensive exports; hurting production and employment.

On the other hand, a weak domestic currency translates into:

- More expensive imports; hurting the consumer.

- Cheaper exports; boosting production and employment.

So, considering all of the issues and uncertainties the world is currently facing, how can a country create a competitive advantage in global trade? To start, one could actively manage their foreign exchange market. Shifting from globalization to localization, a weaker currency boosts trade, making exports more competitive while discouraging imports.

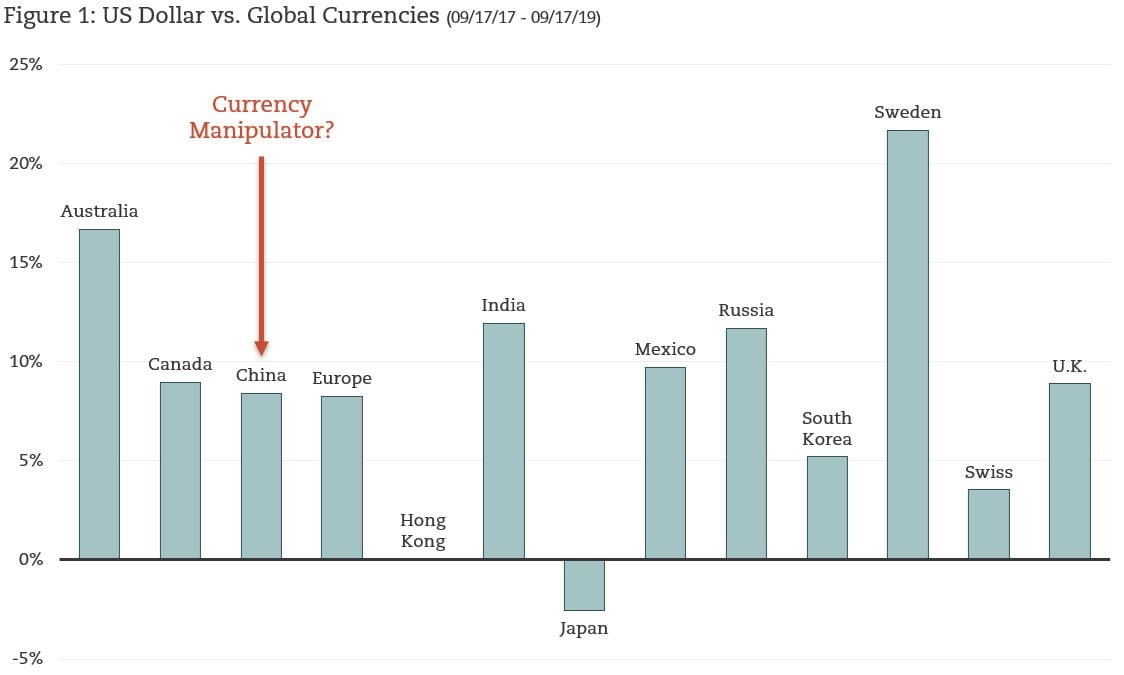

Figure 1 Illustrates the performance of the US dollar against several global currencies over a two year period. Above zero per cent the horizontal axis, the US dollar has appreciated against the respective currency, while below zero per cent, the US dollar has depreciated.

Bottom Line

As it turns out, the US dollar has been strong against the majority of the world – an unappealing feature in the midst of a trade war. Ironically, the strong US dollar has led to the US to label China as a “currency manipulator”. Justifiable or is it everyone? You be the judge.