At SANDSTONE, we’ve been talking about share buybacks for the last 4 or 5 years at our OUTLOOK events. Back in 2016 we said “Share buybacks are approaching record levels. Companies have been able to artificially boost earnings per share by reducing the number of shares outstanding rather than by growing real earnings.” The truth is that buyback activity tends to rise and fall with markets. But not in the way you’d expect. For buybacks, it is often the case that extreme buying happens when market reaches highs (as in 2007 and 2015) and minimal buying when the market was low (2009).

Why would a corporation buyback stock?

- Buybacks usually support stock prices by reducing share counts and boosting earnings per share – making a business look more attractive to investors.

- Buybacks can make a lot of sense when companies feel their stock is undervalued – the issuing company can repurchase some of its shares at a reduced price.

- A company might want to reduce the equity capital on their balance sheet if there’s not a lot of growth to be had in their industry.

Why were buybacks the highest they’ve ever been?

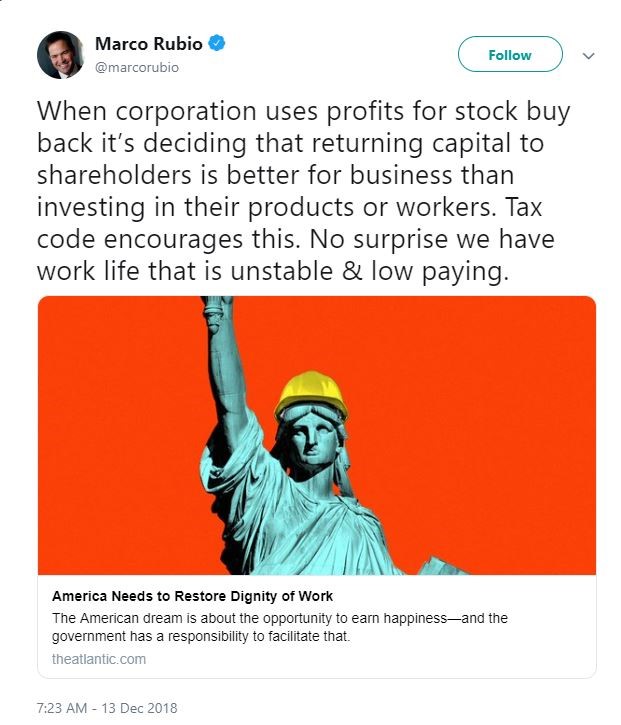

US companies were actively buying their own stock due in part to the earnings boost they received when their corporate tax rates were lowered from 35 per cent to 21 per cent in 2017. A tax cut that was supposed to encourage corporations to put money into wages, job creation or capital expenditures but that just didn’t happen.

Low interest rates play a part too.

Corporations are borrowing money to fund their buybacks because the interest rates are lower than their potential gains. The cyclically adjusted price-to-earnings ratio (CAPE) shows that in 2018 the S&P 500 was the most overvalued it has been since the late 1990s dot-com bubble. But this didn’t slow down buyback at all. Instead, corporations just kept borrowing. And US corporate debit reached $9 trillion halfway through 2018.

Normally, successful companies invest most of their available cash into operations so that they can make more money in the future. But last year, for the first time in 20 years, share buybacks surpassed capital spending.

Bottom line:

Corporate buybacks were illegal until 1982 because they were deemed a way to manipulate the market. Last year, we witnessed the buoying effect buybacks could have on the market. If corporations continue to put more money into corporate buybacks than capital spending, the divide between the haves and the have-nots will continue to grow, consumer and the economy will suffer, and populism will continue to rise.

At Sandstone we believe that doing research, grounding our thinking in historical data and keeping our eye on the big picture helps our clients minimize risk and capture opportunity. Interested in learning more about our philosophy? We’d love to hear from you.